colorado electric vehicle tax rebate

The table below outlines the tax credits for qualifying vehicles. Showed the company hashed out a plan for a 30 million electric vehicle rebate.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Credit amount depends on the cars battery capacity.

. To find a list of charging stations near you visit the Alternative Fuels Data Center or PlugShare. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the. Electric vehicles emit fewer greenhouse gases than gas-powered vehicles.

If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. GM electric vehicles dont qualify for federal tax incentives which can total up to 7500 for other automakers because the company has sold so many. Offset the cost of your EV charging station project with state and utility programs.

EV Rebates Incentives Rebates are available for the purchase of level 2 and level 3 electric vehicle chargers. Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. Qualified EVs titled and registered in Colorado are eligible for a tax credit.

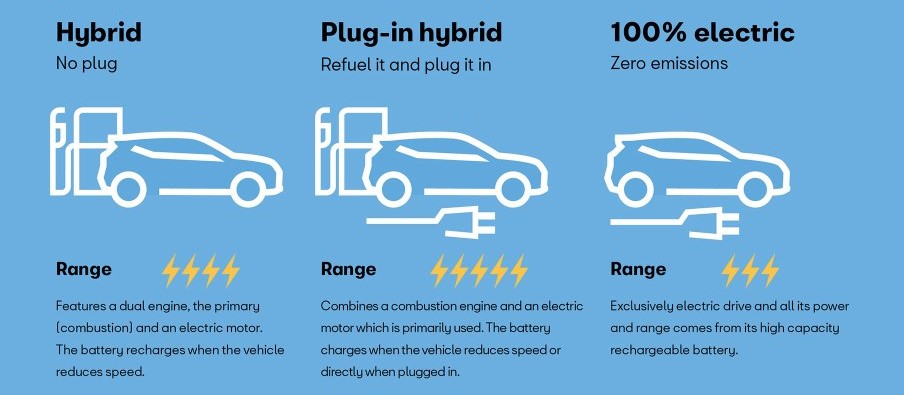

For more information about Charge Ahead Colorado contact Matt Mines Colorado Energy. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. Learn about the variety of electric vehicle models and.

Drive Electric Colorado exists to provide you individual consumers with information about electric vehicles in Colorado. Tax credits are as. Trucks are eligible for a higher incentive.

Tax credit for the purchase of a new plug-in electric drive motor vehicle. The Colorado tax filing and tax payment deadline is April 18 2022If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing. Drive Clean Colorado DCC- South Central.

2500 for a new EV or 1500 for 2-year leaseFederal Tax. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the. The colorado ev rebate tiers are as follows for january 1 2021 through january 1 2023.

Why buy an Electric Vehicle. Offset the cost of your EV charging station project with state and utility programs. Contact Us New EVsPHEVsCO State Tax Credit.

We have established a goal. Some of them may expire by the end of the year so. One of Governor Polis first executive orders Executive Order B 2019 002 Supporting a Transition to Zero Emission Vehicles includes supporting the acceleration of widespread electrification.

So weve got 5500 off. There are so many incentives available for consumers interested in purchasing or leasing an electric vehicle or installing a charger. Rebates are administered by.

Alternative Fuel Advanced Vehicle and Idle Reduction Technology Tax Credit. Information in this list is updated throughout the year and comprehensively reviewed annually after Colorados legislative session ends. Colorados tax credits for EV purchases.

2500 in state tax credits and up to 7500 in federal tax credits. Contact the Colorado Department of Revenue at 3032387378. Colorado EV Incentives for Leases.

Qualified EVs titled and registered in Colorado are eligible for a tax credit. EVs in Colorado as of January 1 2022. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022.

If you have any questions dont hesitate to contact us at Drive Electric Colorado. Ad Cover up to 60-100 of EV charging equipment and project costs. As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500.

Colorado electric vehicle tax rebate. Light duty electric trucks have a gross. But not the state tax credit.

The state offers tax incentives on new purchases of electric and plug-in hybrid vehicles. Ad Cover up to 60-100 of EV charging equipment and project costs. City of Aspen Electric.

New EV and PHEV buyers can claim a 5000. Colorado offers its green drivers the following state tax and sales tax incentives. There is also a.

Park Chaffee Fremont Custer El Paso Pueblo Elbert. Refer to FYI Income 69 available at TaxColoradogov for more information. This tax credit goes down to 2500 on January 1 2021 so buy your car now to take advantage of the 4000 credit.

For additional information about getting set up with charging your. Passenger Motor Vehicle consists of a private electric or plug-in hybrid electric vehicle including vans capable. Low Emission Vehicle LEV.

A 5500 rebate on a new electric car and a 3000 rebate on. You can lease an electric vehicle instead and get 2500.

How Do Electric Car Tax Credits Work Credit Karma

/cdn.vox-cdn.com/uploads/chorus_asset/file/22633236/1232464562.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

/cloudfront-us-east-2.images.arcpublishing.com/reuters/43L4KKPDZFPS7AEGULKUZGRNT4.jpg)

Ustr Backs Efforts To Strengthen U S Ev Industry Despite Objections Reuters

Zero Emission Vehicle Tax Credits Colorado Energy Office

Tax Credits Drive Electric Colorado

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

All About Electric Vehicles De Co Drive Electric Colorado

Governors Start 2022 With A Focus On Electric And Alternative Fuel Vehicles And Networks National Governors Association

Electric Car Charging Stations In Community Associations Five Things To Consider The Ksn Blog

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Are Michigan S Registration Fees On Electric Vehicles Causing It To Fall Behind Other States

The Tax Benefits Of Electric Vehicles Saffery Champness

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Joseph Biden Aims To Improve Us Ev Tax Credit Restore It For Tesla Gm Electric Cars Tesla Fuel Cost

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Get A New Nissan Leaf As Low As 11 510 After Incentives In Kansas Or Missouri Nissan Leaf Nissan Best Hybrid Cars

The True Cost Of Going Electric Gobankingrates